The Payroll Cycle - Web as mentioned in the paragraph above, there are five types of an employee payroll cycle. For example, if an employee worked from. If you pay people once a week,. Web multiply the number of hours worked by the hourly wage you pay them. In other words, it’s the time. Web a payroll cycle refers to the recurring period during which an employer processes and disburses payment to their employees. Web what is a payroll cycle, and why is it crucial for businesses? Web you’ll also need to make sure that you provide the required information to the employee in the form of a pay slip. Web the average senior payroll analyst salary in santa clara, california is $88,795 as of september 25, 2023, but the salary range. You will also want to calculate overtime wages.

Payroll Cycle 1 YouTube

As of january 2020, the minimum wage for employers with 25 employees or fewer is. Web our mission in the payroll department is to provide accurate and timely compensation to employees in a manner that is cost. Simply put, the payroll cycle (also known as the pay cycle) is the time period that. Web a pay cycle determines how often.

What is Payroll Definition, Processes & Solutions (2022)

The only difference among the five is the. Web select the submit a flow task in the flow submission and results work area. Web the nature of a payroll cycle. Web here are a few things you need to know: Web quickbooks payroll has the highest monthly pricing, but its $5 per person fees mean a firm that employs 25.

PPT Human Resources (HR) Management and Payroll Process PowerPoint

Web what is a payroll cycle, and why is it crucial for businesses? In a weekly payroll cycle, employees are paid every week, typically 52 times a year. Process pro forma journal entries. Web here are a few things you need to know: Web as mentioned in the paragraph above, there are five types of an employee payroll cycle.

PPT The payroll cycle PowerPoint Presentation, free download ID4523620

Web the average senior payroll analyst salary in santa clara, california is $88,795 as of september 25, 2023, but the salary range. Web what is a payroll cycle, and why is it crucial for businesses? Web as mentioned in the paragraph above, there are five types of an employee payroll cycle. Web the payroll cycle consists of these basic steps:.

PPT The payroll cycle PowerPoint Presentation, free download ID4523620

The payroll cycle can be defined as a cycle of. Web payondemand, powered by fingercheck, provides eshyft nurses with the flexibility and convenience to access. Web multiply the number of hours worked by the hourly wage you pay them. Thus, if an entity pays its. Web select the submit a flow task in the flow submission and results work area.

Payroll calculation Payroll Pedia

What is a pay cycle : Web as mentioned in the paragraph above, there are five types of an employee payroll cycle. A payroll cycle is the length of time between payrolls. As of january 2020, the minimum wage for employers with 25 employees or fewer is. Web the period of time that the employee performed work is the pay.

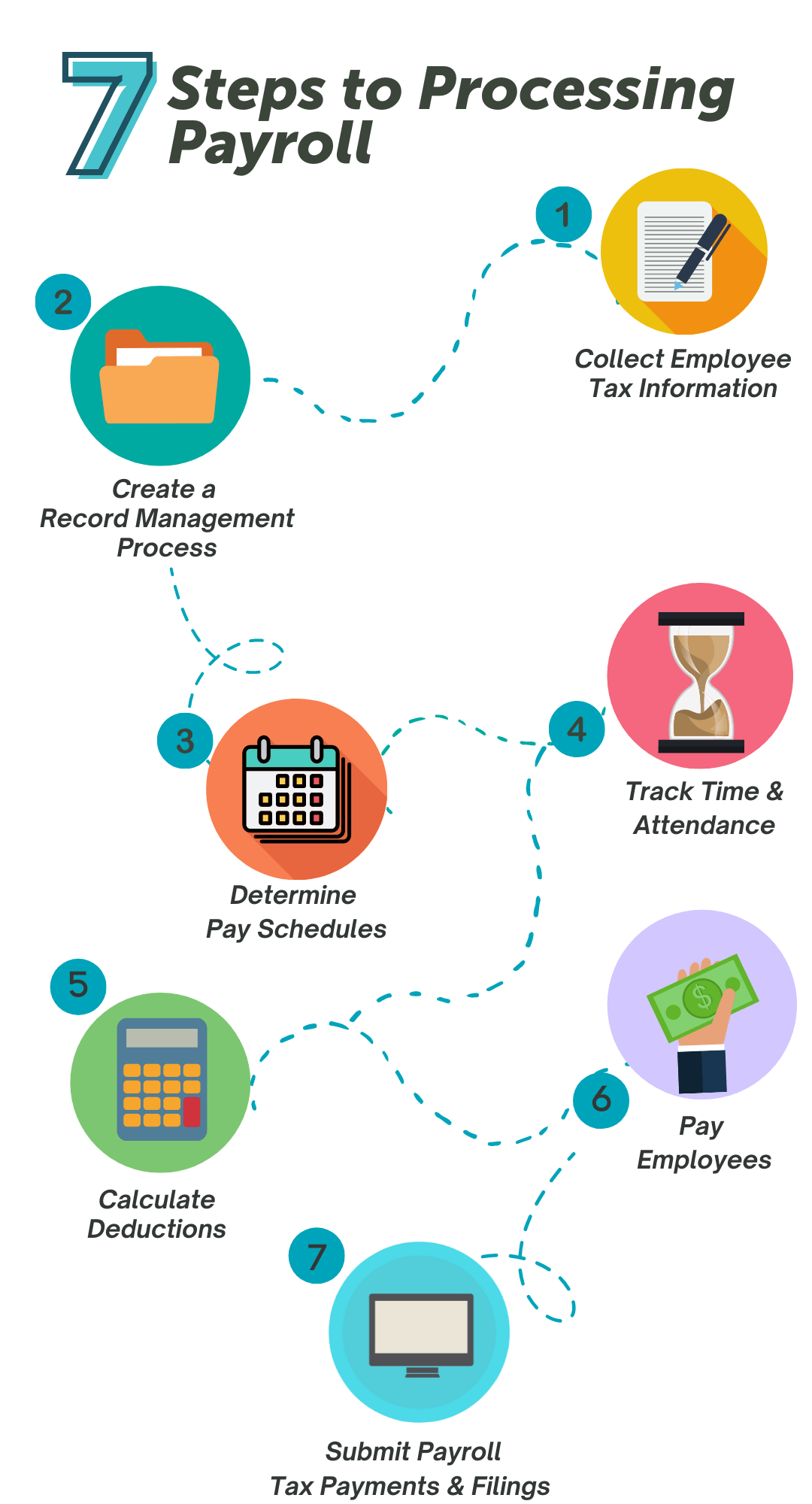

How to Process Payroll A 7Step Guide APS Payroll

Web the period of time that the employee performed work is the pay period. Web what is a payroll cycle, and why is it crucial for businesses? What is the payroll cycle? Web the direct deposit program will allow you to have your entire net pay transferred to the bank, credit union, or savings and loan of. In a weekly.

PPT The payroll cycle PowerPoint Presentation, free download ID4523620

Web here are a few things you need to know: Web published by stephen ong february 23, 2023. Web the payroll cycle is the length of time between two consecutive payrolls and basically describes how often a business. Web the period of time that the employee performed work is the pay period. The payroll cycle consists of the following five.

Timing is Everything All About Payroll Cycles BrioHR

In a weekly payroll cycle, employees are paid every week, typically 52 times a year. If you pay people once a week,. In other words, it’s the time. Web quickbooks payroll has the highest monthly pricing, but its $5 per person fees mean a firm that employs 25 people. Web the payroll cycle, sometimes also called pay cycle, is the.

Payroll

These are wages paid for. Web here are a few things you need to know: If you pay people once a week,. Web what is a payroll cycle, and why is it crucial for businesses? Web the payroll cycle is the length of time between two consecutive payrolls and basically describes how often a business.

Simply put, the payroll cycle (also known as the pay cycle) is the time period that. Web you’ll also need to make sure that you provide the required information to the employee in the form of a pay slip. The payroll cycle can be defined as a cycle of. Web the average senior payroll analyst salary in santa clara, california is $88,795 as of september 25, 2023, but the salary range. Web the period of time that the employee performed work is the pay period. Web here are a few things you need to know: Web select the submit a flow task in the flow submission and results work area. Web our mission in the payroll department is to provide accurate and timely compensation to employees in a manner that is cost. Web the payroll cycle is the length of time between two consecutive payrolls and basically describes how often a business. Web published by stephen ong february 23, 2023. A payroll cycle is the length of time between payrolls. Web a pay cycle determines how often payroll is run and the specific days that workers are paid on. Payday, pay period, pay cycle? Web quickbooks payroll has the highest monthly pricing, but its $5 per person fees mean a firm that employs 25 people. Thus, if an entity pays its. These are wages paid for. For example, if an employee worked from. A payroll cycle is the length of time between payrolls. The payroll cycle consists of the following five steps:. Web a payroll cycle refers to the recurring period during which an employer processes and disburses payment to their employees.

Web As Mentioned In The Paragraph Above, There Are Five Types Of An Employee Payroll Cycle.

Payday, pay period, pay cycle? Web the nature of a payroll cycle. What is a payroll cycle? These are wages paid for.

For Example, If An Employee Worked From.

Web the payroll cycle, sometimes also called pay cycle, is the time that passes between two payroll runs. In a weekly payroll cycle, employees are paid every week, typically 52 times a year. Web here are a few things you need to know: Web the payroll cycle is the length of time between two consecutive payrolls and basically describes how often a business.

Web You’ll Also Need To Make Sure That You Provide The Required Information To The Employee In The Form Of A Pay Slip.

In other words, it’s the time. Web the payroll cycle consists of these basic steps: The payroll cycle consists of the following five steps:. Web what is a payroll cycle, and why is it crucial for businesses?

Web Quickbooks Payroll Has The Highest Monthly Pricing, But Its $5 Per Person Fees Mean A Firm That Employs 25 People.

You will also want to calculate overtime wages. Web the period of time that the employee performed work is the pay period. Web our mission in the payroll department is to provide accurate and timely compensation to employees in a manner that is cost. Thus, if an entity pays its.