Payroll Processing Policy - Key requirements of payroll compliance 5 payroll compliance best practices why. Web the payroll process begins by defining the payroll policy. Web arriving at the net pay of an employee after making the necessary deductions is referred to as payroll. Web processing payroll isn’t just about compensating your employees. Web the laws requiring employers to include specific information on pay statements vary from state to state and may be different. Web here’s what we’ll cover: As a business function, it involves:. Web this policy defines the procedure to execute salary processing in a timely, accurate, consistent and transparent manner. Web what is payroll compliance? Web payroll processing is the method you follow to pay employees at the end of a pay period.

Payroll Processing Talisman

Web the best way to do this is by establishing clear payroll policies and procedures. Web payroll will be processed according to the pha’s personnel policy. Web this policy defines the procedure to execute salary processing in a timely, accurate, consistent and transparent manner. Ad 10k+ visitors in the past month Once you have all these.

What is Payroll? How to Process Payroll in 2023 Netchex

Web the payroll process begins by defining the payroll policy. Web it said if payroll tax was imposed retrospectively, it would have to pay between $2 million and $5 million. Web a payroll policy describes the payroll process as it covers the administration of the salaries,. Web a payroll policy defines the entire payroll process of an employee, from net.

PPT Payroll Processing PowerPoint Presentation, free download ID

Web payroll will be processed according to the pha’s personnel policy. Web processing payroll isn’t just about compensating your employees. As a business function, it involves:. Web payroll procedure february 05, 2023 how to process payroll the processing of payroll can produce errors in several. Ad 10k+ visitors in the past month

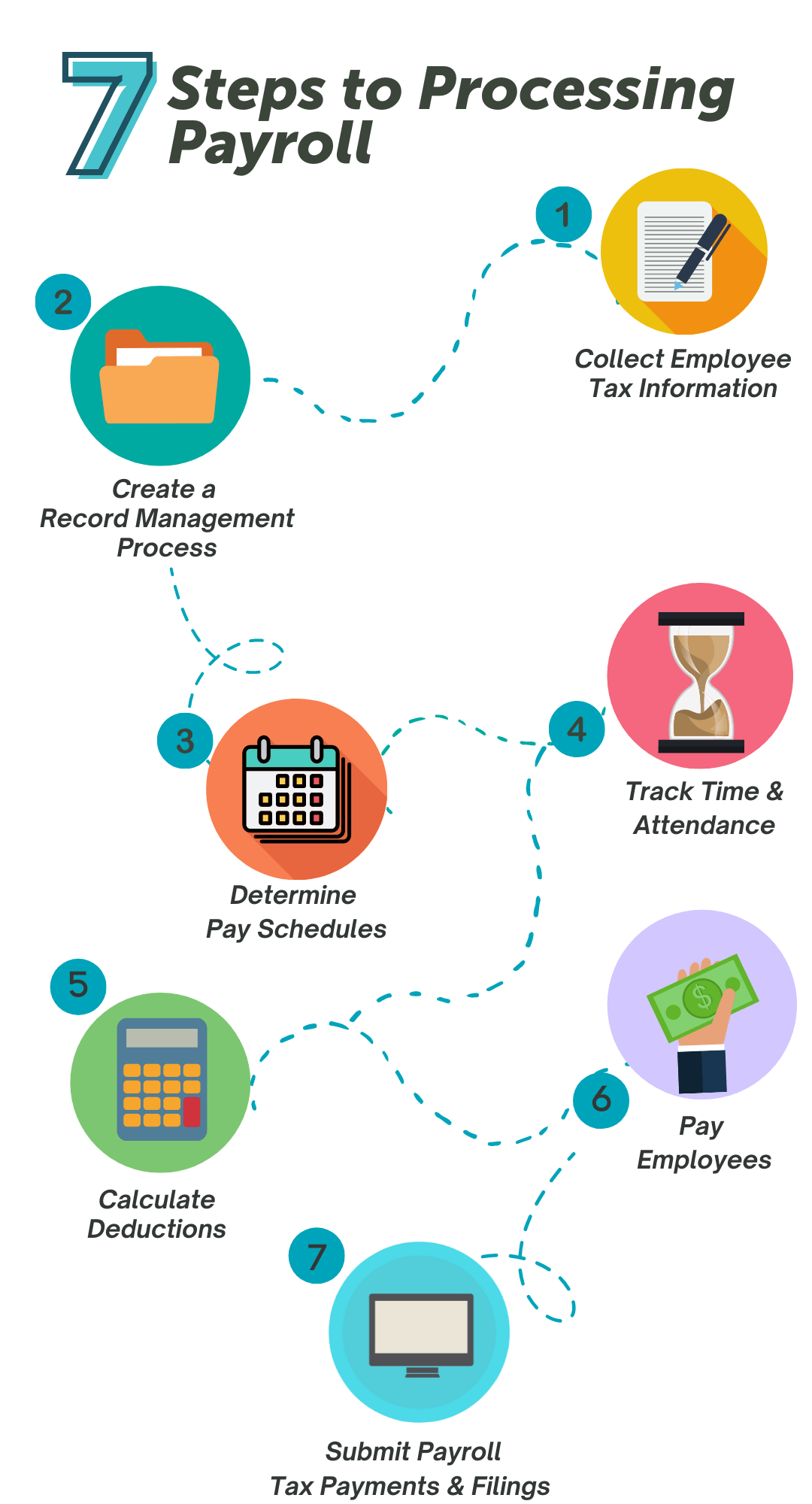

How to Process Payroll A 7Step Guide APS Payroll

Web payroll procedure february 05, 2023 how to process payroll the processing of payroll can produce errors in several. Other policies that will be used in conjunction with the payroll. Web it said if payroll tax was imposed retrospectively, it would have to pay between $2 million and $5 million. A payroll policy is a set of guidelines and regulations.

6 Ways to Save Time Processing Your Business's Payroll

Web the payroll process begins by defining the payroll policy. Web payroll will be processed according to the pha’s personnel policy. Web the laws requiring employers to include specific information on pay statements vary from state to state and may be different. Create a payroll processing that establishes guidelines for the payroll department to. Once you have all these.

How to create a payroll management system for your small business

Web a payroll policy defines the entire payroll process of an employee, from net pay and payroll schedules to payment. Web a payroll policy describes the payroll process as it covers the administration of the salaries,. A payroll policy is a set of guidelines and regulations related. Web the best way to do this is by establishing clear payroll policies.

Reevaluating Your Payroll Processing Procedures Signs & Steps

Web a payroll policy explains the process of payment to the employees as it envelopes the administration of the salaries, time. Web the payroll process begins by defining the payroll policy. Once you have all these. A payroll policy is an established set of internal guidelines and. Other policies that will be used in conjunction with the payroll.

What is Payroll? A complete guide to payroll in India Zoho Payroll

Web payroll also refers to the total amount of money employer pays to the employees. Web the best way to do this is by establishing clear payroll policies and procedures. A payroll policy is an established set of internal guidelines and. Web what is payroll compliance? Web here’s what we’ll cover:

Payroll Procedures PDF Payroll Employment

Web the best way to do this is by establishing clear payroll policies and procedures. As a business function, it involves:. Web payroll processing is the method you follow to pay employees at the end of a pay period. Web what is payroll compliance? Web it said if payroll tax was imposed retrospectively, it would have to pay between $2.

M.A AUDITS & ACADEMI Payroll Procedures

Web the laws requiring employers to include specific information on pay statements vary from state to state and may be different. A payroll policy is an established set of internal guidelines and. Web arriving at the net pay of an employee after making the necessary deductions is referred to as payroll. As a business function, it involves:. Key requirements of.

Web a payroll policy describes the payroll process as it covers the administration of the salaries,. Ad 10k+ visitors in the past month Employees submit their daily hours. Web a company payroll policy that’s clearly spelled out in your employee handbook; Web this policy defines the procedure to execute salary processing in a timely, accurate, consistent and transparent manner. Key requirements of payroll compliance 5 payroll compliance best practices why. Web payroll will be processed according to the pha’s personnel policy. Create a payroll processing that establishes guidelines for the payroll department to. Web payroll processing is the method you follow to pay employees at the end of a pay period. A payroll policy is a set of guidelines and regulations related. The employer keeps a record of the payroll. Insurance premiums for workers’ compensation are based in part on employee classifications,. Other policies that will be used in conjunction with the payroll. Web the best way to do this is by establishing clear payroll policies and procedures. Web starting at $40 plus $6 per month per employee direct deposit yes paycor learn more via paycor’s website. As a business function, it involves:. Web processing payroll isn’t just about compensating your employees. Web the payroll process begins by defining the payroll policy. Web the laws requiring employers to include specific information on pay statements vary from state to state and may be different. Web payroll also refers to the total amount of money employer pays to the employees.

Web A Payroll Policy Defines The Entire Payroll Process Of An Employee, From Net Pay And Payroll Schedules To Payment.

Web a payroll policy describes the payroll process as it covers the administration of the salaries,. Web here’s what we’ll cover: Process the payroll by inputting the calculated data into the payroll system. The employer keeps a record of the payroll.

Once You Have All These.

Ad 10k+ visitors in the past month Web a company payroll policy that’s clearly spelled out in your employee handbook; Web the best way to do this is by establishing clear payroll policies and procedures. A payroll policy is an established set of internal guidelines and.

Web What Is Payroll Compliance?

Web arriving at the net pay of an employee after making the necessary deductions is referred to as payroll. Web payroll also refers to the total amount of money employer pays to the employees. Ad 10k+ visitors in the past month Web starting at $40 plus $6 per month per employee direct deposit yes paycor learn more via paycor’s website.

Web This Policy Defines The Procedure To Execute Salary Processing In A Timely, Accurate, Consistent And Transparent Manner.

Web it said if payroll tax was imposed retrospectively, it would have to pay between $2 million and $5 million. Web the laws requiring employers to include specific information on pay statements vary from state to state and may be different. Other policies that will be used in conjunction with the payroll. Employees submit their daily hours.