How To Set Up Payroll For Nonprofit - Web how to set up payroll for a nonprofit setting up payroll for nonprofit organizations starts with providing information to the. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Normally, this will be one. Here are some tips on. Profits are reported as income. Pillar two limits the ability of countries to compete for. Get 3 months free payroll! Web nonprofit payroll works similar to payroll for businesses when it comes to withholding payroll taxes and paying. Make the switch to adp. Web setting up the nonprofit payroll system and software automated payroll tax payments and filing calculating and managing employee.

Payroll Software For Nonprofit Organizations ERPNext

What is a pay period? Simple, detailed employee and volunteer hours. Profits are reported as income. Web over the past five years or so, the social security wage base has increased by an average of about $3,960 a year. Your pay period is the schedule on which you pay your employees.

Understanding Nonprofit Payroll A NoStress Guide

Pillar two limits the ability of countries to compete for. Best for quickbooks accounting users. Get 3 months free payroll! Web from profit shifting, and creating a simple system. Web setting up the nonprofit payroll system and software automated payroll tax payments and filing calculating and managing employee.

How to Set Up Payroll for a Small Business Payroll 101

Web by making a few small changes, you can make sure your account uses terms, reports, and forms used in. Web quickbooks payroll has the highest monthly pricing, but its $5 per person fees mean a firm that employs 25 people. Web 5 steps to start a nonprofit. Pillar two limits the ability of countries to compete for. Profits are.

Learn How to Set Up Payroll For Your Small Business Carbonate HR

Managing compensation and processing payroll for a. Web timing is an important consideration. Make the switch to adp. Web by making a few small changes, you can make sure your account uses terms, reports, and forms used in. I've learned of the unlimited power of a community with a.

How To Set Up a Payroll System

Get 3 months free payroll! Web each will be paid a small base salary, plus a percentage of the money raised at the event. Get 3 months free payroll! Payment plan (installment agreement) electronic federal. Make the switch to adp.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Pillar two limits the ability of countries to compete for. Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Set shared goals to empower communities. Web asap payroll services can help you navigate the ins and outs of managing your particular payroll needs. I've learned of the unlimited power of a community with a.

How to set up a payroll process 10 steps

Here’s how you do it: Ad most dependable payroll solution for small businesses in 2023 by techradar editors. Best overall payroll software for small businesses by business.com Make the switch to adp. Web nonprofit payroll works similar to payroll for businesses when it comes to withholding payroll taxes and paying.

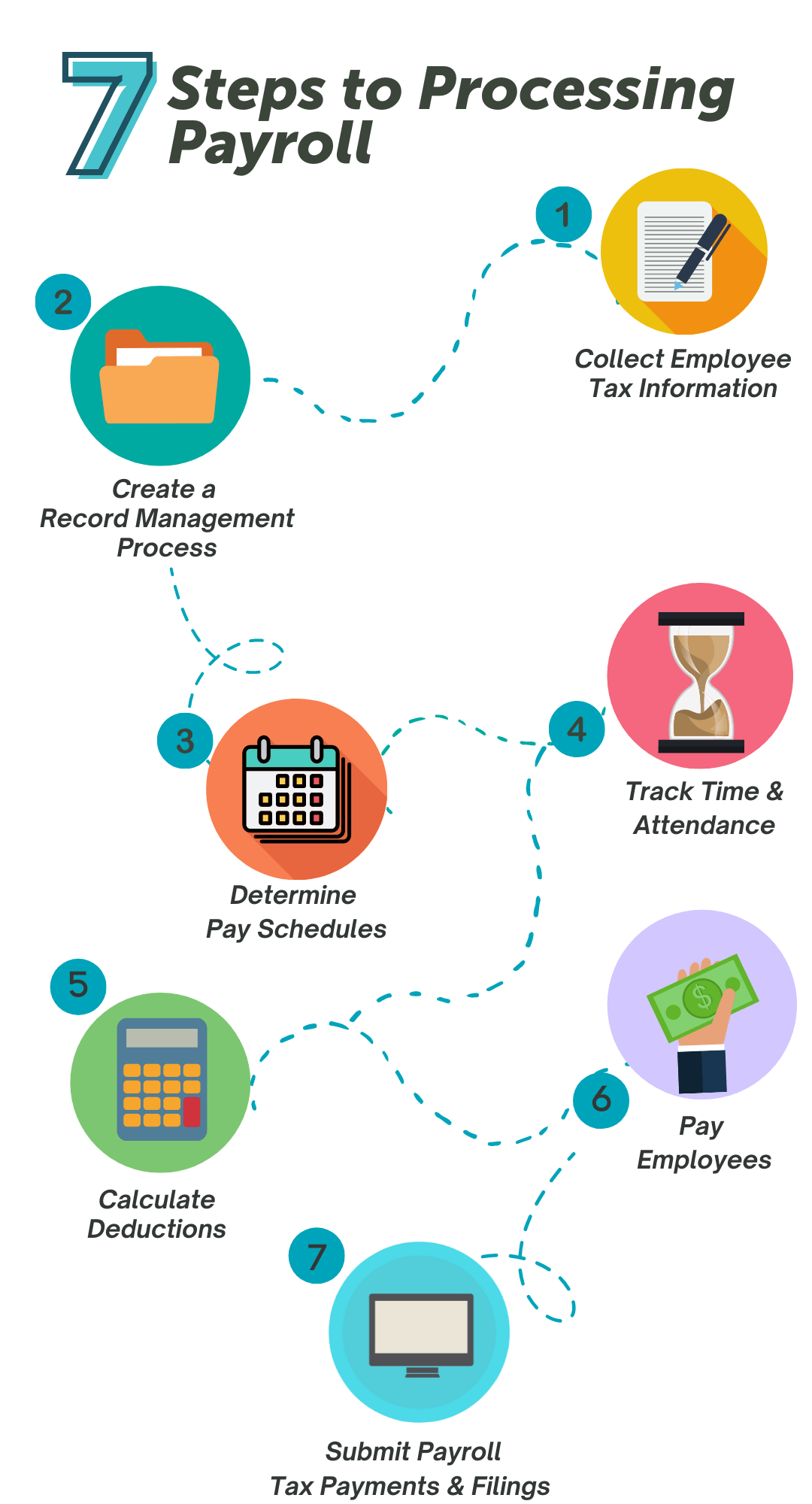

How to Process Payroll A 7Step Guide APS Payroll

Managing compensation and processing payroll for a. Web setting up the nonprofit payroll system and software automated payroll tax payments and filing calculating and managing employee. Web each will be paid a small base salary, plus a percentage of the money raised at the event. Plus we offer a 10%. Get 3 months free payroll!

Understanding Nonprofit Payroll A NoStress Guide

Web set your nonprofit board up for success by understanding its purpose, best practices, legal responsibilities and more. Here’s how you do it: Web each will be paid a small base salary, plus a percentage of the money raised at the event. Best overall payroll software for small businesses by business.com Before committing to starting a nonprofit, it is.

Tips For Setting Up Payroll In QuickBooks Online QuickBooks Australia

Web how to set up payroll for a nonprofit setting up payroll for nonprofit organizations starts with providing information to the. Web over the past five years or so, the social security wage base has increased by an average of about $3,960 a year. Web by making a few small changes, you can make sure your account uses terms, reports,.

Web nonprofit payroll solutions that meet the needs of the nonprofit and social services environment, including: Here’s how you do it: Web 5 steps to start a nonprofit. Ad fast, easy, & affordable small business payroll by adp®. Web nonprofit payroll works similar to payroll for businesses when it comes to withholding payroll taxes and paying. Web just set up manual payroll in your client’s program settings to track their payroll. Best for quickbooks accounting users. Web how much should a nonprofit pay its employees? Web set your nonprofit board up for success by understanding its purpose, best practices, legal responsibilities and more. Set shared goals to empower communities. Here are some tips on. Make the switch to adp. Web timing is an important consideration. Simple, detailed employee and volunteer hours. Web how to set up payroll for a nonprofit setting up payroll for nonprofit organizations starts with providing information to the. Web industries nonprofits and 501 (c) (3) industry expertise perfect for all nonprofits whether you’re a public charity,. Plus we offer a 10%. Bank account (direct pay) debit or credit card; Before committing to starting a nonprofit, it is. Web setting up the nonprofit payroll system and software automated payroll tax payments and filing calculating and managing employee.

Bank Account (Direct Pay) Debit Or Credit Card;

Plus we offer a 10%. Web quickbooks payroll has the highest monthly pricing, but its $5 per person fees mean a firm that employs 25 people. Best overall payroll software for small businesses by business.com Normally, this will be one.

Profits Are Reported As Income.

Web how much should a nonprofit pay its employees? What is a pay period? Here are some tips on. I've learned of the unlimited power of a community with a.

Get 3 Months Free Payroll!

Get 3 months free payroll! Make the switch to adp. Web from profit shifting, and creating a simple system. Web just set up manual payroll in your client’s program settings to track their payroll.

Web Asap Payroll Services Can Help You Navigate The Ins And Outs Of Managing Your Particular Payroll Needs.

Web nonprofit payroll solutions that meet the needs of the nonprofit and social services environment, including: Web timing is an important consideration. Web 5 steps to start a nonprofit. Web over the past five years or so, the social security wage base has increased by an average of about $3,960 a year.